When you use Transactor's Remitter to process a bulk remittance

Transactor does most of the hard work for you but you do need to tie up a few things after the process.

It's straight forward book-keeping and if you follow this topic you'll find it easy.

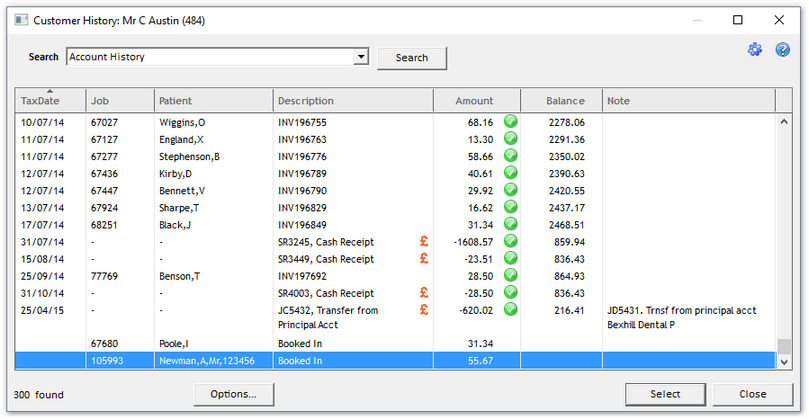

What we are aiming for, in each customer's history window, is nice green ticks next to the remitted invoices. Like this..

This example takes over from the Menu: Import a Remittance File walk through but it also applies equally well to Menu: Select Invoices To Pay and Menu: Select Summary Invoice

So let's say the Remitter has processed the example remittance from the Menu: Import a Remittance File topic.

Remittance validity summary

25/04/2016 10:33hrs remitbexhill_feb2015.csv

ROWS AMOUNT TYPE COMMENT

75 2513.16 OK

1 -500.00 SKIP Remit amount < 0

1 40.10 SKIP Inv or Crnote does not exist

-------------------

77 2053.26 Total

* advisory notes *

There's -500 of credits which are not processed by the remitter.

By hand you may also need to do these in Transactor Lab Manager (after running the Remitter ideally):

On the principal account:

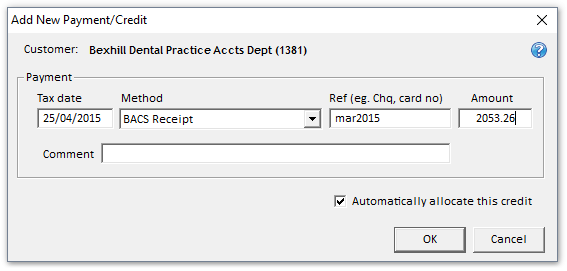

Enter the Payment Credit for the total remittance amount you actually received (eg. CR BACS receipt £1000.00 )

Also enter any special Credits (eg. CR Settlement Discount £100.00)

Allocate those Credits to the DR Transfers.

In Theory they should balance, but you can add further payment adjustments to balance the account as required.

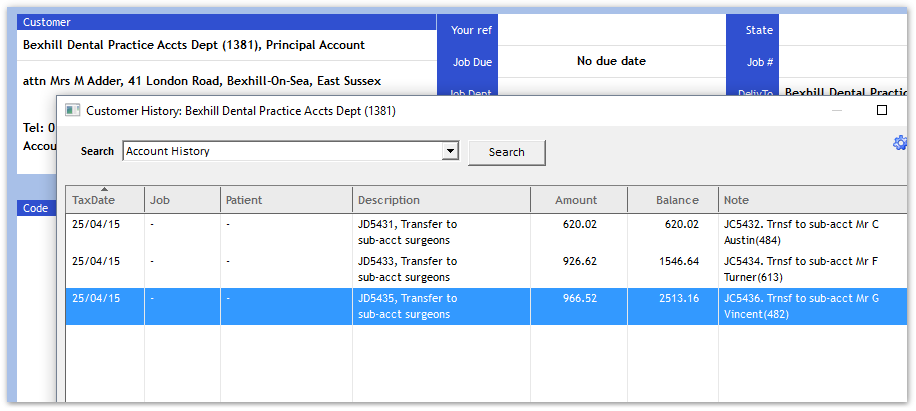

Notice the Balance is £ 2513.16 exactly the same as the Remitter reported earlier.

Remittance validity summary

25/04/2016 10:33hrs remitbexhill_feb2015.csv

ROWS AMOUNT TYPE COMMENT

75 2513.16 OK

1 -500.00 SKIP Remit amount < 0

1 40.10 SKIP Inv or Crnote does not exist

-------------------

77 2053.26 Total

* advisory notes *

There's -500 of credits which are not processed by the remitter.

In this case we can see that we havn't put the Remittance payment on yet, but it's a good time to do it now..

Save yourself some hassle and check your bank account to see the ACTUAL amount received from the principal account. If you don't know at this point wait until you do.

Let Transactor automatically allocate it..

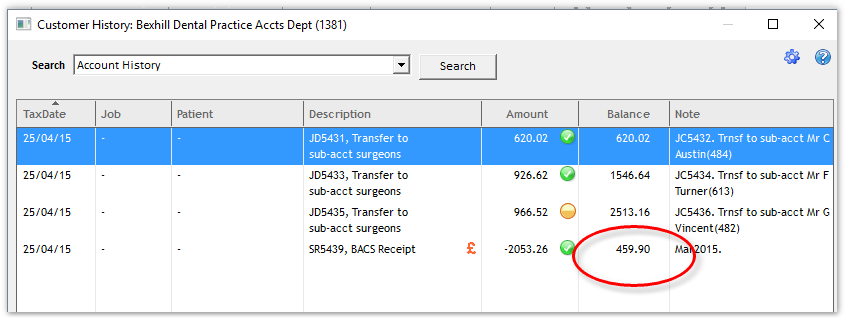

Have another look at the Customer History..

Hang on a minute. The balance is £459.90 what's that about?

It's because, quiet correctly we added a payment for the actual BACs money received.

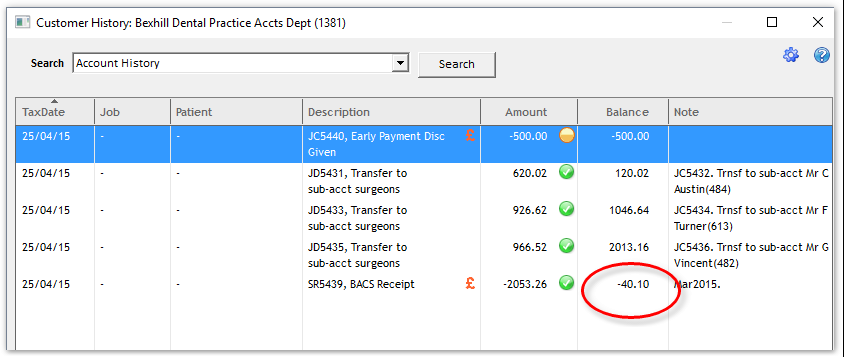

We still need to deal with the £500 credit, so add a Payment Credit of type Credit Adjustment or Early Payment Discount etc. Again, allow it to auto-allocate.

Bingo. all is well. £40.10 is a credit left on account. The customer remitted for a non-existent invoice, or perhaps made a typo. Either way it'll come out in the wash.

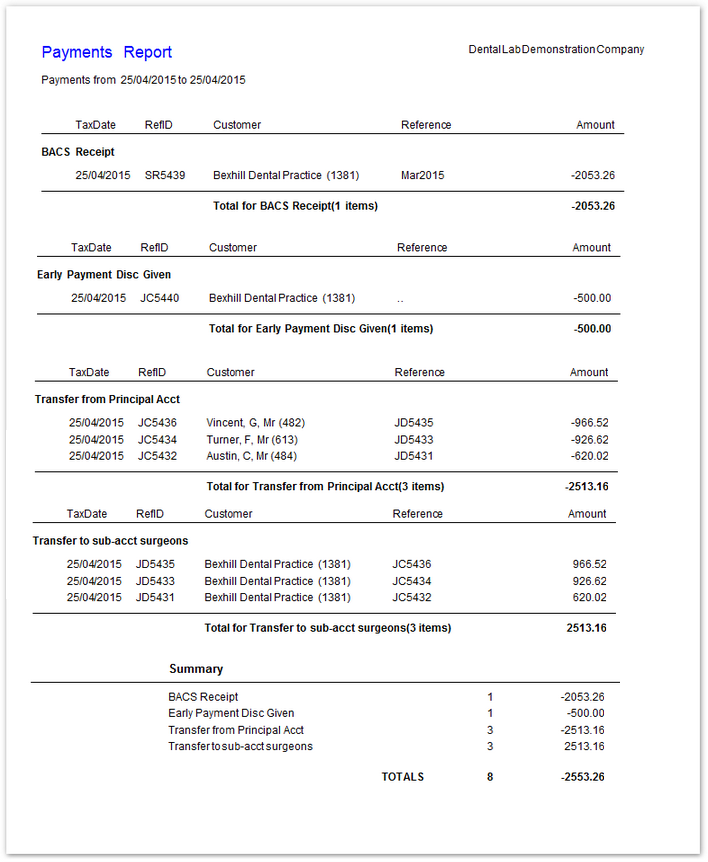

The Summary report from the remitter shows this very well.

Remittance validity summary

25/04/2016 10:33hrs remitbexhill_feb2015.csv

ROWS AMOUNT TYPE COMMENT

75 2513.16 OK

1 -500.00 SKIP Remit amount < 0

1 40.10 SKIP Inv or Crnote does not exist

-------------------

77 2053.26 Total

* advisory notes *

There's -500 of credits which are not processed by the remitter.

What to do with the 40.10 credit if it's still hanging around ?

If you can identify the real invoice that it was meant to pay off, then transfer the credit to the sub-account, then in the sub-account allocate that credit to the offending invoice.

Principal Account:

Make Refund/Debit, choose type 'Transfer to sub-account', fill in the amount and give the sub-account name in comments.

Sub-account:

Add Payment Credit, choose type 'Transfer from Principal acct'.

Either allow it to auto-allocate or do it manually to the exact invoice.

Finally let's take a look at some useful financial reports

Reports/Accounting/Payments

For the example we've used the taxdate we gave in the Remitter, but you should use a taxdate range appropriate for your circumstances.