If you regularly receive large remittances from Principal Accounts to pay off invoices for several accounts, then you may be better off getting the Transactor Remitter add-on module.

Also see: Managing Principal accounts with the Remitter

To enter principal account remittances without the Transactor Remitter add-on:

1. On the Principal Account enter the whole value of the Remittance. Also add payment credits for any discounts that apply.

2. For each of the Sub-accounts, transfer their value from the Principal Account to the Sub account as follows:

| ♦ | Select the 'source' Principal Account onto the Main Form |

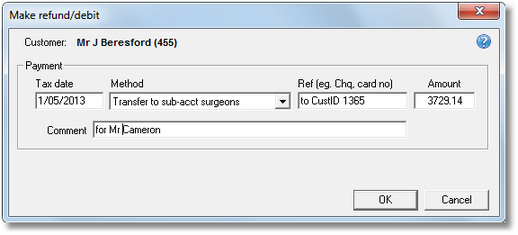

| ♦ | From the Customer menu, choose Make Refund/Debit and select payment method 'Transfer to Sub-account', enter the target CustID as the Ref, and set the Value. |

| ♦ | Select the 'target' Sub-Account onto the Main Form |

| ♦ | Choose Customer menu > Add Payment/Credit and select payment method 'Transfer from Principal Acct', enter the principal account's CustID as the Ref, and set the Value. |

Allow Transactor to Automatically Allocate the credit (recommended).

Example: Transferring value from the Principal Account to a Sub account

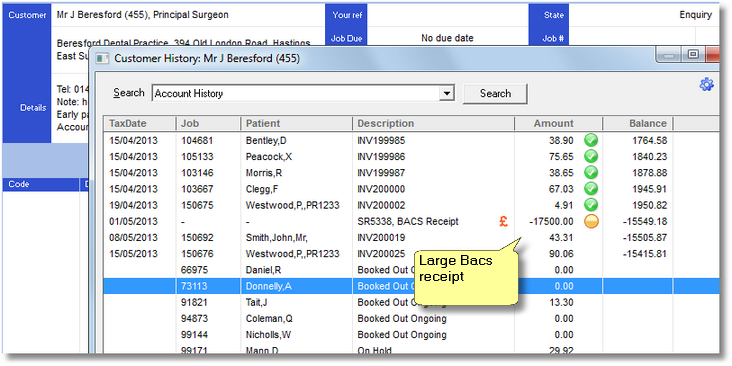

Customer account 455 has remitted a BACS payment of 17500.00, 1950.82 of which is to pay off his Summary Invoice for April, plus pay for two other dentist accounts.

This image of the account history window clearly shows this customer's situation after the receipt has been entered, but before the other accounts are paid off with any transfers.

We make a refund/debit 'Transfer to sub-acct dentists' for each sub-account. In the example below we're stating a debit of 3729.14 should be added to the principal account which represents the amount owing to account 1365.

Now, select Customer ID 1365 onto the Main Form,

Choose Customer menu > Add payment/ credit

Choose appropriate tax date

Choose method 'transfer fm principal acct.'

Repeat for any additional dentists by making a "Refund/Debit" on the principal account, and making a "Payment/Credit" on the sub-account.

Job done.

Note

If you regularly receive large remittances from Principal Accounts to pay off invoices for several accounts, then you may be better off getting the Transactor Remitter add-on module.