To improve your cash flow, reduce your administration overheads and make your customers happier:

Manage your debtors!

Lab Manager has all the functionality to manage your debtors however there is a saying in the computer industry 'rubbish in - rubbish out' so you also need to get your ship in order. This article may help you to do that.

There are many ways to crack an egg therefore this topic is by it's nature, subjective. Use it or not, it's up to you.

Universal Tips

| • | Simple is best: If you have complicated price lists, with loads of variations on prices, more than 2 or 3 price bands, special prices for one customer and inconsistent selling rules - you are asking for trouble. Rather than have complicated price variations, or add on strange and wonderful extras, why not use the 'swings & roundabout' approach. See: Danger of Inconsistent Pricing |

| • | Use clear, accurate invoicing & statements: Make it easy for your customer to see what they are being charged for. If you are charging for many smaller jobs, send/email a Summary Invoice Detailed and also an accompanying account Statement (with aged debt) |

| • | Incentivize your customers to remit in time: Use the carrot rather than the stick. Use early payment discounts rather than interest charge threats which just upset people and don't usually work. Include a monthly statement which will show any 'early payment credits' they have received for the previous month, and any credit notes or refunds. See: Customer discounts, |

| • | Be clear and consistent: Give your customers the information they need, on time. If they have debt outside of your terms make this fact clear on your statements and use the 'dripping tap' method of sending regular Aged Statements, and/or Statement of Unpaid items, with a friendly personalised compliment slip until your customer is trading within your terms. |

| • | Provide a good service, at a fair price, and insist on being paid within reasonable terms: Far from upsetting your customer they will respect you for it. |

Some other stuff you might want to know about payments and allocations

So not to repeat ourselves, we'll assume you have done the minimum topics in the Coffee Break Tutorial such as Booking Out and Invoicing a Job, Managing Payments & Remittances and Printing monthly invoices and statements

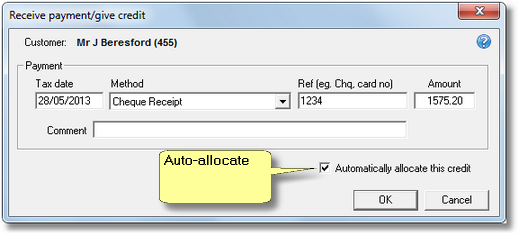

When entering payment credits (receipts) or making credits, you can leave the 'Automatically allocate this credit' ticked. Lab Manager will simply allocate the credit on an oldest first principal.

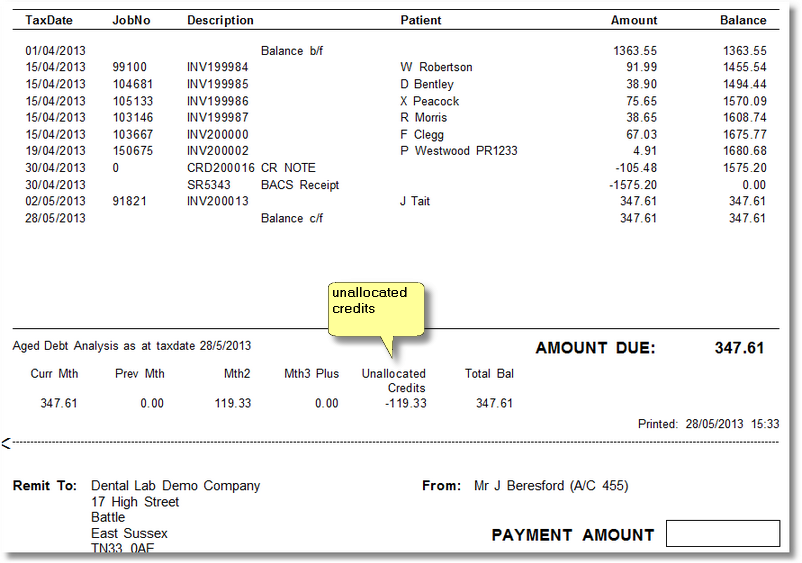

If you Void an Invoice perhaps because you wanted to modify or delete a previously booked out charged job (not recommended, better to raise a credit note), then you may then have an unallocated credit on account. These 'unallocated credits' will show up on an aged statement.. (Report > Customers > Statement - Aged) and Aged Debtors report (Report > Accounting > Aged Debtors).

To allocate an unallocated credit

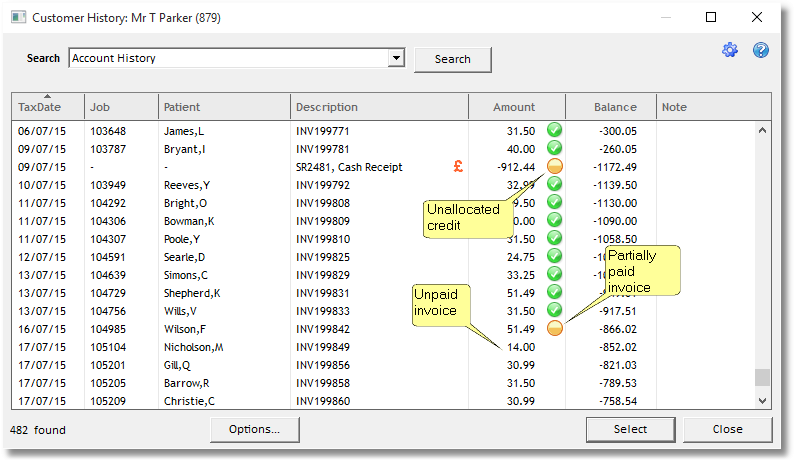

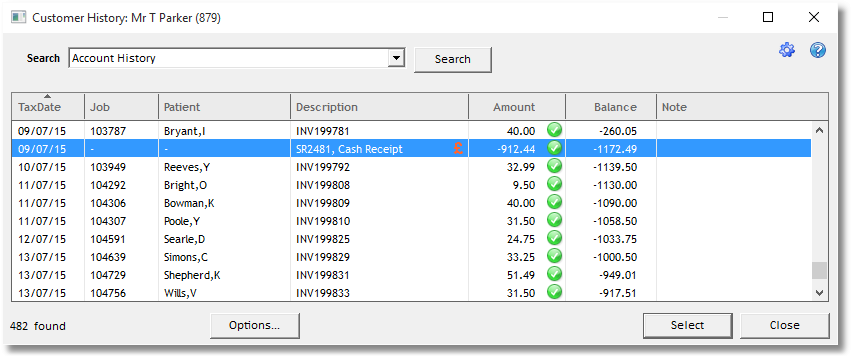

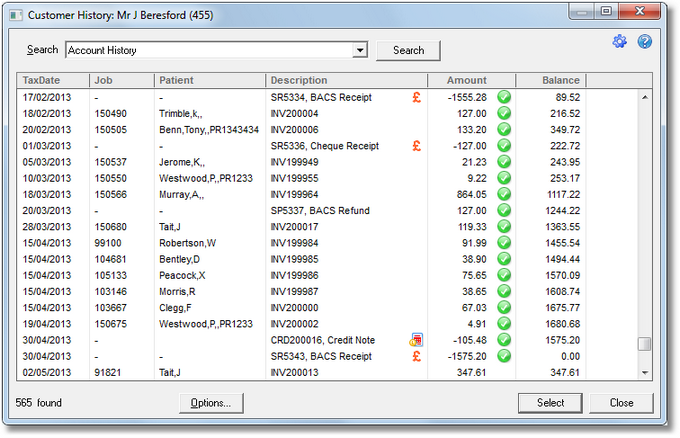

You should be able to easily see which credits are unallocated using Customer > History.

Right click the row with the unallocated credit, choose 'Allocations'..

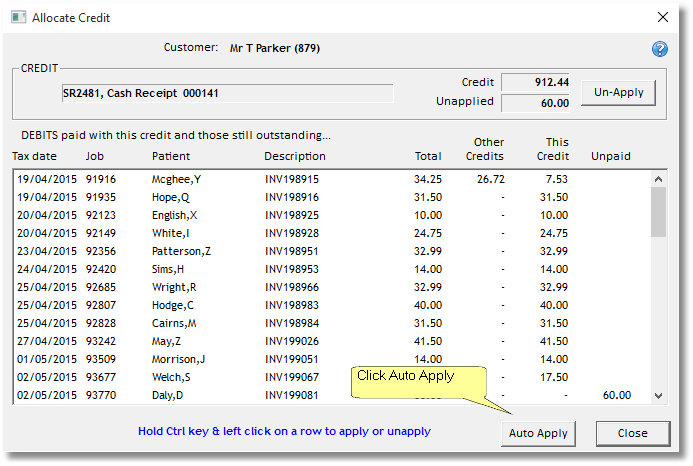

Click Auto-Apply, then Close..

A neat utility to tidy up your payment allocations

If you think your customer payment history (Customer > History) needs tidying up on the allocations get Lab Manager to re-allocate all that customer's payments. The utility allocates all payment credits and credit notes on an oldest first principal.

To Re-allocate all payment credits and credit notes for a customer

| • | Select a customer onto the Main Form |

| • | From the Tools Menu, choose Utilities, then 'Re-allocate all payments for customer..' |

| • | Leave the Customer box set to 'Current customer on main form' |

| • | Choose Ok |

There may be a pause while the account is processed, followed by a confirmation message. If you check the customer's history now, you'll find that it is now tidy.

Other useful stuff

You may find some of these management and accounting reports useful in managing your debtors.

Reports - Accounting - Aged Debtors

Reports - Accounting - Payments Report