The good news is that you don't need to understand Double-entry Bookkeeping as Transactor Lab Manager does it for you in the background.

Managers with or without bookkeeping skills may simply make use of the Managers Financial Report which has all the information presented in the user friendly Readable Accounts Format (RAF).

However, if you are interested in learning more about how bookkeeping works, then this topic is for you.

What is Double-entry Bookkeeping?

This is defined on wikipedia as "A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts".

| • | Double Entry accounting is based on the principal that for every Debit entry, there will always be an equal Credit entry. |

| • | Credits are usually shown as Negative values in columns which aren't explicitly labeled Credit or CR. |

| • | If there's one rule of thumb to remember, then it's this one: The so called golden rule of accounting "debit the receiver and credit the giver'. |

Debit the Receiver, Credit the Giver

How this works is best explained with this example.

When you Add a Payment /Credit in Lab Manager, you just enter the amount, choose a payment type (eg BACS Receipt), and click Ok.

What you don't see (unless you look at the Transactions list) is that Lab Manager makes the following transactions for you:

Credit the Customer's account (which also credits the Accounts Receivable account - see below)

Debit the Bank Account

So the Customer here, is the Giver because they have given money to the company, from the perspective of 'the company'.

The Bank Account is the Receiver because it has received money from the company, from the perspective of 'the company'.

Explaining the Accounts Receivable nominal account

People often ask what this is. It's an account which represents all the Sales ledger customer accounts in one lump. In fact in some bookkeeping systems it's actually called the 'The SL Customer Total' account.

They do this because it would be impractical, on most accounting reports, if each customer had it's own Nominal account, to list 100s, or 1000s, of nominal account rows.

Instead, each customer has a 'Customer account' which records all the payment and invoice transactions out and in. But with each transaction, an entry is also 'silently' made in the Accounts Receivable nominal account. By looking up the latter account we can easily see the totals for all customers.

Examples

The next example records the sale of some goods and services, and the subsequent remittance. Note that the Accounts Receivable account represents all the sales ledger customers. (Of course the system does keep track of all the individual customer accounts in the background, these each have their Customer account number but this is not the same as a Nominal Account number). The Accounts Receivable account is also called the 'Sales Ledger Total' account in some systems because it totals up all the sales ledger customer accounts.

In this example, you may imagine just one customer as being represented by the Accounts Receivable account.

Invoice customer for sale of goods or services

|

Debit |

Credit |

Balance |

Accounts Receivable (Debit the receiver. Customers owe us for goods/services provided) |

1000.00 |

|

1000.00 |

Sales Income-Crown&Bridge (Credit the giver. Stock or services 'given' to us from this account) |

|

800.00 |

200.00 |

Tax liability account (Credit the giver. Owed to the tax man) |

|

200.00 |

0.00 |

Notice that although the customers were invoiced for 1000.00, 200 of this is tax and so doesn't get credited to the Sales account.

Ok that's the Sales Invoices represented, what about the customer's remittance payments?

The Bank Account is the receiver of the money, and the customer is the Giver so:

Receive payment/remittance from customer

|

Debit |

Credit |

Balance |

Bank account 1 (debit the receiver) |

1000.00 |

|

-1000.00 |

Accounts receivable (credit the giver) |

|

1000.00 |

0.00 |

Still ok, let's add it all up and do a nominal report on this.

Nominal account summary

|

Debit |

Credit |

Balance |

Accounts Receivable |

1000.00 |

1000.00 |

0.00 |

Sales Income-Crown&Bridge |

|

800.00 |

800.00 |

Tax liability |

|

200.00 |

1000.00 |

Bank account 1 |

1000.00 |

|

0.00 |

Trial balance |

2000.00 |

2000.00 |

0.00 |

That was easy but in real life things don't always happen so conveniently. Customers may not pay all of the Invoices off immediately. There's also early payment discounts etc. to record. So let's now take a look at a more realistic nominal account activity.

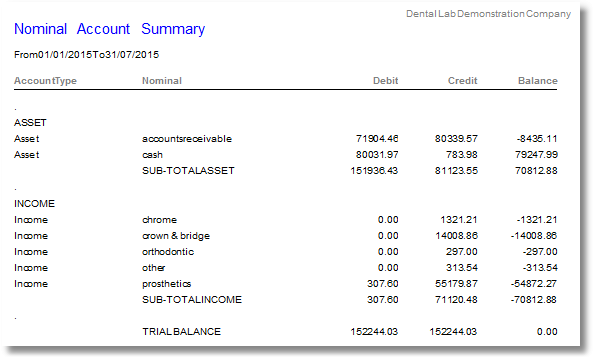

A look at the Nominal Account Summary

If this report is making your eyes water, then use the Managers Financial Report instead, it is fine for most purposes.

As the Nominal Summary report is using standard double-entry book keeping notation, the golden rule of accounting "debit the receiver and credit the giver" applies. To see how that works let's look at an Income account such as Sales income-Crown&Bridge. This records the Sales of goods or services to the customer.

Why is a sales income account credited when sales are Invoiced for, and debited if a Credit note is raised?

The 'receiver' here is the customer 'totals for all customers' account, (Accounts Receivable) who has received goods or services. So that's the 'Debit the Receiver' rule. There always has to be an opposite transaction in book keeping. In this case this is the account which records the sale. In a way, it is 'Giving' goods and services and so that's the 'Credit the giver' rule.